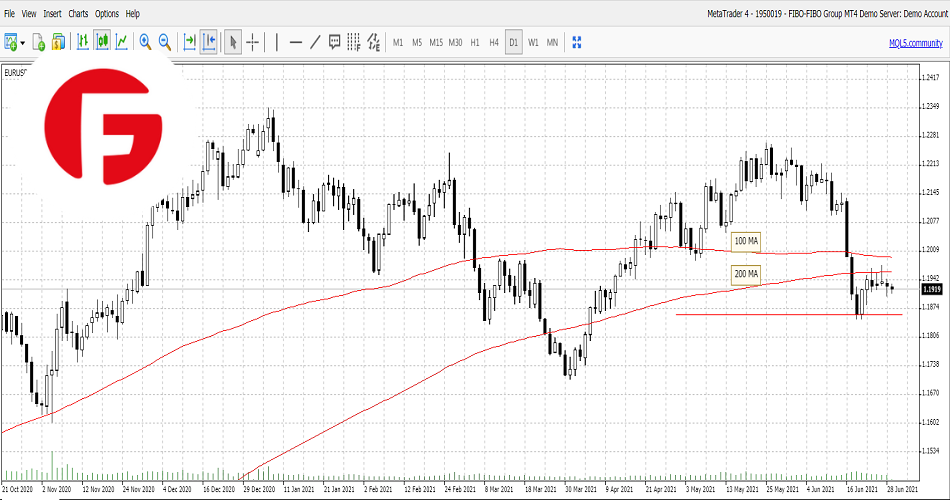

Euro/USD

The Euro continues to grind lower against its US counterpart in today’s trading session, leaving the greenback at around a two-month high as the market awaits the non-farm payrolls data on Friday which is likely to determine the US Federal Reserve’s rate policy as the year unfolds.

The main question hanging over the market is when a tapering of asset purchases and higher rates would be needed and the figured due out on Friday may go a long way to answering those questions. The U.S. Labor Department is expected to report a gain of 690,000 jobs in June, compared with 559,000 in May while the unemployment rate is expected to fall to 5.7% which continues the remarkable turnaround of the US economy from the depths of the coronavirus.

The possibility of even better jobs figures than the market expects looms large which will probably see the Euro push even lower against the US dollar heading into Friday, as nobody wants to be tied up in a long trade against the world’s most popular currency and a number above the 700,000 mark may bring an interest rate hike to the US economy earlier than expected.

Since the U.S. central bank’s policy meeting earlier this month, traders have penciled in at least two 0.25% interest rate increases by the end of 2023. Since bouncing of the $1.1850 mark around a week ago, the Euro has been caught up in a tight range with investors afraid to take long positions and this is expected to continue until the end of the week when the jobs data from the US is released.

This support level is likely to be tested again in the coming days but for now, any chance of breaking down lower than this level seems remote as there are plenty of buyers waiting to step in at this mark.