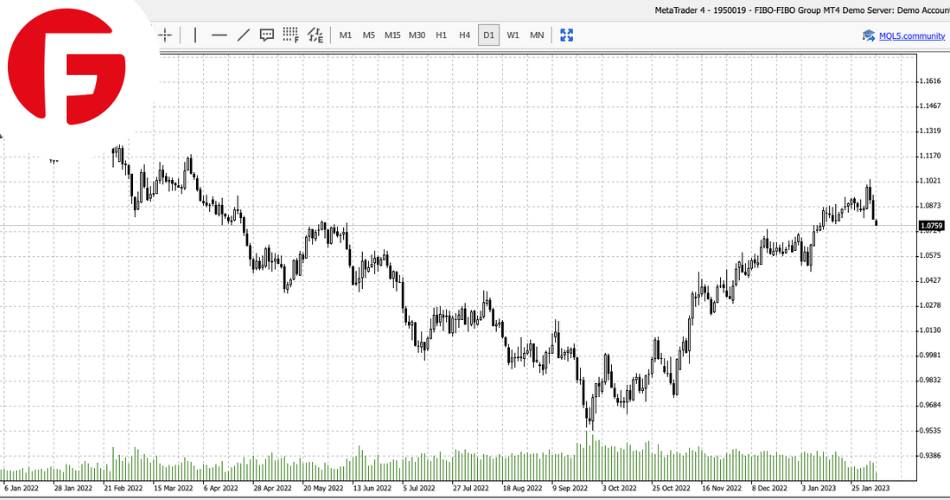

EUR/USD

The Euro is off to a slow start against the US dollar as we enter a new trading week as market participants continue to digest the bumper jobs report from the US last Friday that guarantees the US Federal reserve will continue their rate hiking cycle throughout the year.

Jobs growth in the world’s largest economy surged last month, adding 517,00 to nonfarm payrolls in January which was well above the 185,000 predicted by analysts and almost double the +260K in December, which was revised up from +223K.

The unemployment rate ticked down to 3.4%, the lowest unemployment rate since 1969, and also beat the 3.6% rate expected by analysts and higher than the 3.5% in December.

The surprisingly high headline figure shows that the economy still has plenty of strength, which means the Federal Reserve is likely to keep its hawkish tone and more than likely push the Fed funds rate above 5 percent.

Earlier this morning we saw the release of retail sales figures from the Eurozone which dropped by 2.7% in January versus analysts’ expectations for a number of -2.5% and well below last month’s figure of 1.2% official figures released by Eurostat showed.

This may show that interest rate hikes in the Eurozone are beginning to work but European Central Bank (ECB) policymaker Robert Holzmann noted that “The risk of doing too little dwarfs the risk of overtightening policy,” which means we can also expect more rate hikes from the ECB.

Looking further ahead today, the main drivers of the EUR/USD currency pair will be the release of a monetary speech by ECB president Christine Lagarde where the question of interest rate hikes will at the foremost of investors’ minds.

Looking further ahead today, the main drivers of the EUR/USD currency pair will be the release of a monetary speech by ECB president Christine Lagarde where the question of interest rate hikes will at the foremost of investors’ minds.

We no Key news due out of the US, market participants will await a similar speech tomorrow from US Federal President Jerome Powell where the question of interest rates will also be on the table.