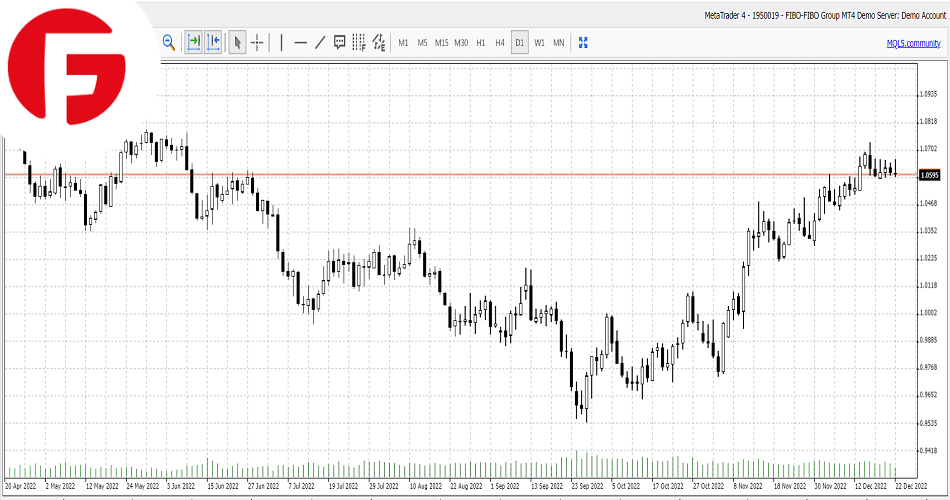

EUR/USD

The Euro has come under pressure against the greenback as we enter the US trading session after a strong round of economic figures from the world’s biggest economy have all but guaranteed further rate hike by the US Federal Reserve in the coming months.

GDP figures just released to the market came in at 3.2 percent against analysts’ expectations for a number of 2.9 percent and considerably higher than the 2.9 percent reading from last month.

The jobs market also looks to remain resilient as the number of Americans filing new claims for unemployment benefits increased less than expected last week, which shows, employment in the US, one of the key indicators for the Fed to continue raising interest rates remains strong.

Initial claims for state unemployment benefits rose 2,000 to a seasonally adjusted 216,000 for the week ended Dec. 17, the Labor Department said on Thursday which was well below the figure of 222,000 expected by analysts.

Just when it was thought that the Fed may be considering a pause in interest rate hiking program the strong data released today has thrown this theory into disarray and now all eyes will be on the release of key data tomorrow as we head into the holidays.

The main drivers of the EUR/USD currency pair tomorrow will be the release of the Core Personal Consumption Expenditures Price Index and Durable goods figures from the US which are both key indicators of consumer spending.

The main drivers of the EUR/USD currency pair tomorrow will be the release of the Core Personal Consumption Expenditures Price Index and Durable goods figures from the US which are both key indicators of consumer spending.

If the numbers come in strongly the Euro is likely to come under pressure as we head into the Christmas break as market participants brace themselves for further rate hikes from the Fed which will only increase the attractiveness of the yield between the Euro and the US dollar.