Euro/USD

The Euro has come under selling pressure as we enter today’s European trading session, on the back of a disastrous round of economic figures from Germany that shows the European economy is still suffering the effects of the Covid 19 pandemic.

The latest factory orders from Germany, Europe’s Powerhouse, hit the market at -6.9% which was well below analysts’ expectations for a figure of -0.5 percent, and it comes at a terrible time for the German economy, as the country has just reintroduced another lockdown targeting the part of the population that remain unvaccinated.

The Euro has been on a downward trend against the US dollar for over six months and considering the release of today’s data and the growing amount of coronavirus cases in the Euroblock, thew fall is certainly justified.

There was some stability last week in the EUR/USD currency pair until US Federal Reserve Chair Jerome Powell noted that the Fed was considering ending its asset buying earlier than previously planned, which is directly at odd with the European Central Bank who feel the need to keep their stimulus program going in order to keep the economy moving forward.

ECB President Christine Lagarde, has been adamant that Eurozone inflation, which is currently well above the central bank’s target rate will be transitory and there is as yest no reason for tighter monetary policy.

Unless Mrs Lagarde changes course, and signals the ECB is ready to tighten monetary policy to reign in inflation, further losses for Euro is more than likely, given that Fed president Powell no longer sees US inflation as transitory.

Looking further ahead today, the economic calendar on both sides of the Atlantic is rather quiet and as far as news is concerned, investors will have to wait until tomorrow’s release of GDP figures from the Eurozone for some trading opportunities in the EUR/USD currency pair.

For today the main focus will be on the latest Covid 19 news, and especially the new Omicron variant of the virus and whether it is continuing to spread throughout Europe and indeed the rest of the world.

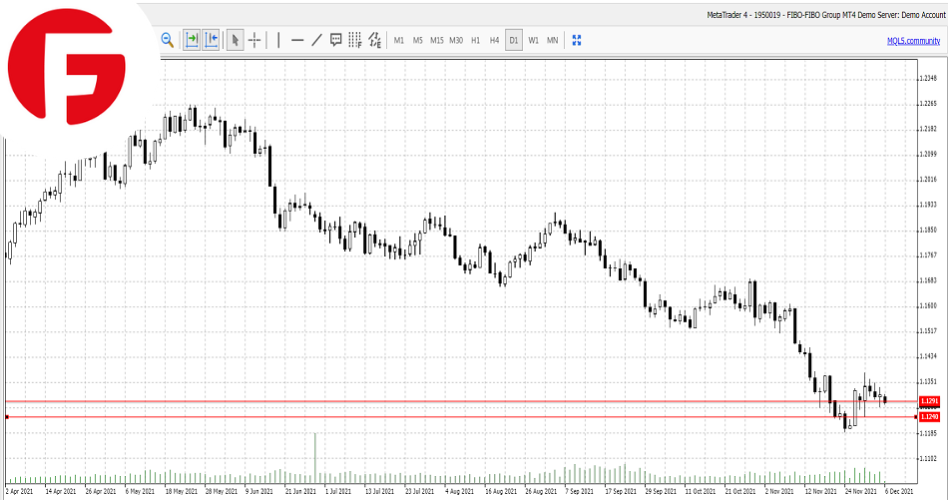

As we can see on the chart, the Euro has found support at the $1.1291c mark but has currently broken down through this level as traders react to the disappointing factory orders figures from Germany.

As we can see on the chart, the Euro has found support at the $1.1291c mark but has currently broken down through this level as traders react to the disappointing factory orders figures from Germany.

As already mentioned, today will all be about the spread of the omicron virus and if there is a sudden uptick in cases, the Euro is likely to see further losses against the greenback and we may see a retest of the next support level at $1.1240