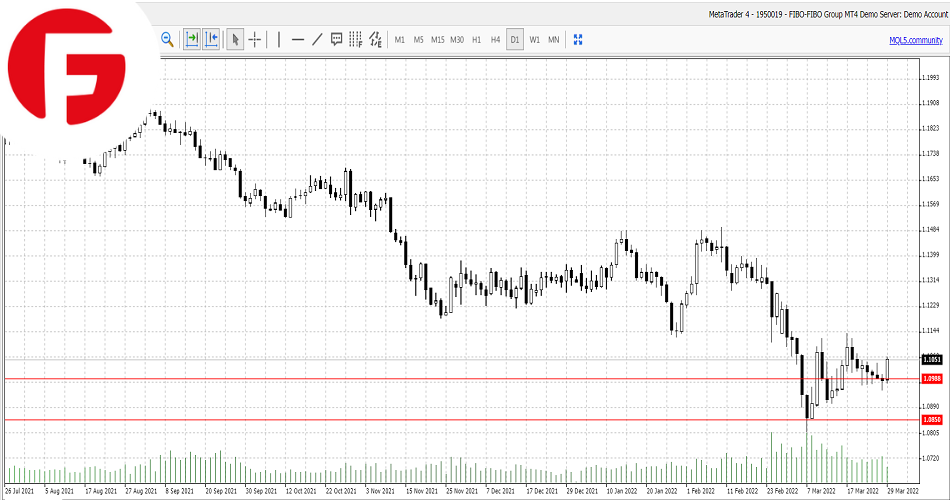

EUR/USD

The Euro has bounced higher against the US dollar as we enter today’s European trading session, brushing off disappointing figures out of the Eurozone as investors concentrate on the bigger picture surrounding Ukraine and Russia.

The latest gfk consumer confidence survey from Germany, Europe’s biggest economy hit the market earlier today at -15 against analysts’ expectations for a figure of -12 and well below last month’s number of -8.5.

The news is very disappointing for the German economy as a whole and just goes to show what a toll the conflict between Ukraine and Russia is taking on the overall European economy which is why the peace talks scheduled for today are of vital importance if the Euro is to sustain any type of rally.

Ukrainian and Russian negotiators are set to meet in Turkey for the first direct talks in more than two weeks and any step towards a ceasefire or a potential peace deal would lend strong support to the Euro as the single currency is seen suffering the most significant economic impact of the conflict.

At this stage there isn’t high hopes for a breakthrough although in recent days the Russian side has toned down a little by abandoning a plan to overthrow the democratically elected government and its president Volodymyr Zelensky

"Markets are in a wait-and-see mode at the moment, as new talks over Ukraine will start later today," said Roberto Mialich, a forex strategist at Unicredit.

Looking further ahead today, the main drivers of the EUR/USD currency pair besides the Ukraine – Russian negotiations will be the release of consumer confidence figures from the US and a strong figure may add to the case of more aggressive rate hikes from the US Federal Reserve.

Looking further ahead today, the main drivers of the EUR/USD currency pair besides the Ukraine – Russian negotiations will be the release of consumer confidence figures from the US and a strong figure may add to the case of more aggressive rate hikes from the US Federal Reserve.

Market participants will also await a monetary speech from Federal Reserve Board member John Williams as well as the home price index figures from the US.